Definition: RSI diversence is a technical tool for analysis that compares the price of an asset to the direction in which it is relative strength (RSI).

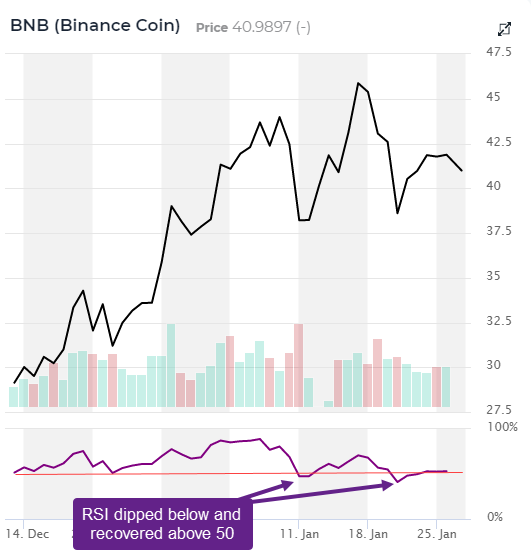

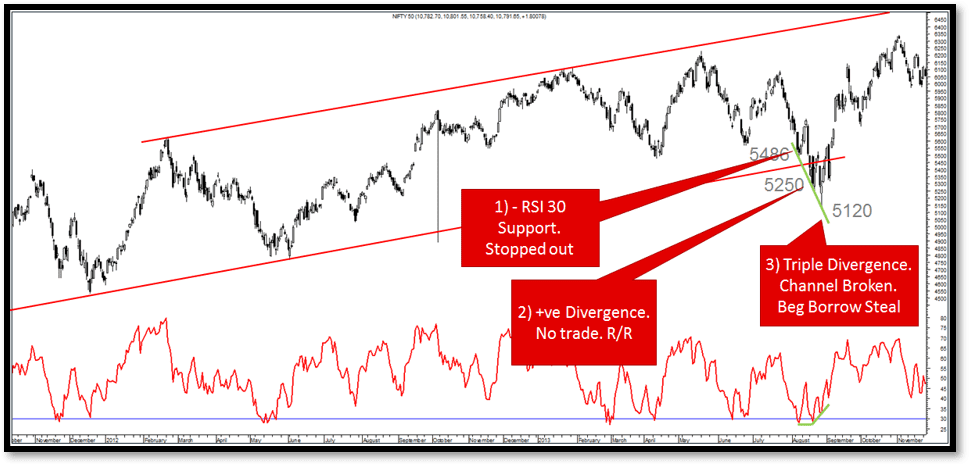

Signal: A positive RSI divergence is considered to be a positive signal. If it is negative, the RSI divergence, however, is considered bearish.

Trend Reversal: RSI divergence could signal the possibility of a trend reverse.

Confirmation - RSI divergence should always be used in conjunction other analysis techniques.

Timeframe: RSI Divergence can be observed in various time frames to gain various insight.

Overbought/Oversold RSI values above 70 indicate an overbought condition. Values lower than 30 mean that the market is undersold.

Interpretation: To understand RSI divergence correctly requires considering other fundamental or technical factors. Follow the top backtesting trading strategies for more info including backtesting trading strategies, divergence trading forex, backtesting strategies, forex tester, automated trading platform, cryptocurrency trading bot, crypto trading backtesting, stop loss, crypto trading backtester, stop loss and more.

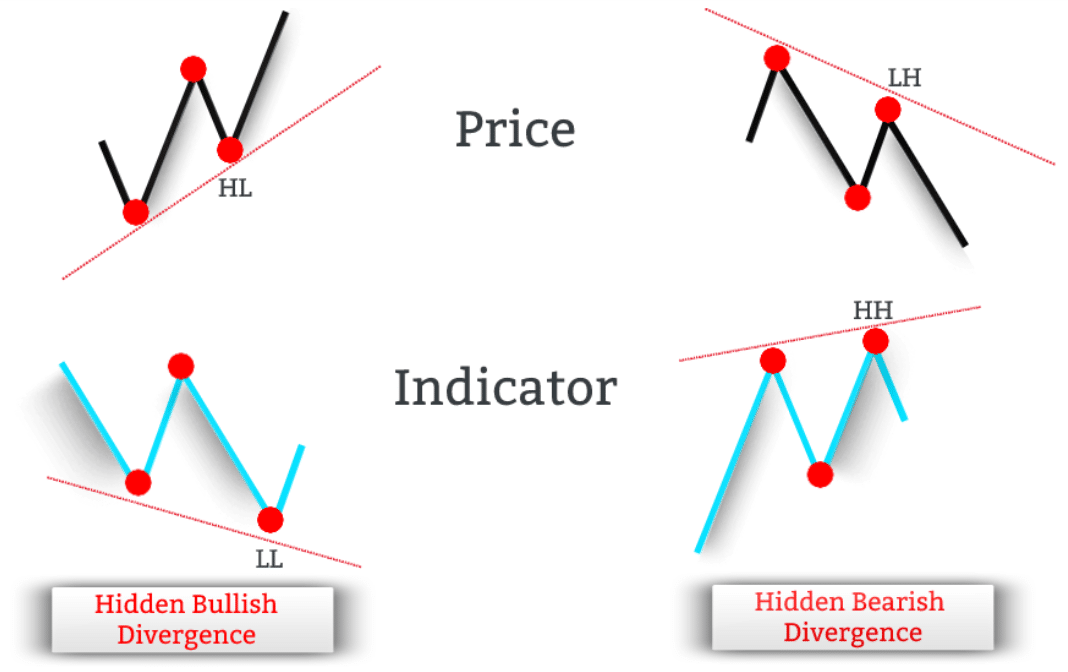

What Is The Distinction Between The Regular And Hidden Divergence?

Regular Divergence - If the value of an asset has a higher peak or lower bottom but the RSI has lower peak or lower bottom, this is referred to as regular divergence. It could be an indication of a trend reversal , but it is essential to consider other fundamental and technical factors. Hidden Divergence: when an asset's price is a lower high/lower low while the RSI makes a higher or lower low. While it's a less powerful indicator than regular divergence it is still a signal of a possible trend reverse.

Take note of these technical aspects:

Trend lines and support/resistance levels

Volume levels

Moving averages

Other technical indicators and oscillators

Important aspects to take into consideration:

Economic information

News specific to companies

Market sentiment and other indicators of sentiment

Global events and their effects on the market

Before you make decisions about investments solely based on RSI divergence indicators, you must be aware of both technical and fundamental factors. Check out the top rated automated trading for more advice including automated crypto trading, forex tester, forex trading, cryptocurrency trading, software for automated trading, trading with divergence, crypto trading bot, RSI divergence, backtesting, forex backtesting software free and more.

What Are Backtesting Trading Methods For Trading Crypto

Backtesting crypto trading strategies is the process of simulated the execution of a trading plan using historical data. This lets you assess the possibility of profit. The following are some steps in backtesting crypto trading strategies:Historical Data: Obtain a historical data set for the crypto asset being traded, including prices, volume, and other relevant market data.

Trading Strategy: Create the trading strategy that will be tested.

Simulation Software: Make use of software to simulate the operation of the trading strategy on the historical data. This allows you to see how the strategy might have worked over time.

Metrics: Utilize metrics to evaluate the effectiveness of your strategy, such as profitability Sharpe, drawdown or any other pertinent measures.

Optimization: Adjust the parameters of the strategy and then repeat the simulation to optimize the strategy's performance.

Validation: Test the method on data that is not published to verify its validity and avoid overfitting.

It is essential to note that the past performance of a trader cannot be used as an indicator of future results. Backtesting results should not ever be relied on for the future performance of a business. Live trading is a live-action scenario, so it is crucial to consider fluctuations in the market, transaction costs, in addition to other real-world elements. See the best backtesting platform for website recommendations including forex backtester, bot for crypto trading, trading platform crypto, trading platform crypto, backtesting strategies, bot for crypto trading, automated trading bot, automated cryptocurrency trading, position sizing calculator, best crypto trading platform and more.

How Do You Evaluate The Forex Backtest Software Used When You Trade With Divergence

When considering forex backtesting software specifically designed for trading with RSI diversification, there are a few important factors to consider Accuracy of data: Make sure the software has easy access to accurate historical data on the currencies being traded.

Flexibility: The software must allow for customization and testing various RSI divergence strategies.

Metrics: This program should offer a wide range of metrics that are used to assess the performance and profitability of RSI divergence strategies.

Speed: The program should be quick and efficient, allowing for quick testing of different strategies.

User-Friendliness: Even for people who have no technical knowledge The software must be easy to learn and use.

Cost: Look at the price of the program. Also, consider whether the software fits within your financial budget.

Support: A good customer service should be provided, including tutorials and technical support.

Integration: The software must be able to integrate with other tools for trading, such as charting software or trading platforms.

Before purchasing subscriptions, it's crucial to check out the software before purchasing it. Follow the best crypto trading for blog info including automated trading platform, automated trading bot, crypto trading bot, backtesting, crypto trading, crypto trading bot, cryptocurrency trading, forex trading, best trading platform, forex backtesting software and more.

How Do Cryptocurrency Trading Robots Function In Automated Trade Software?

A set of pre-determined rules are implemented by crypto trading robots, which execute trades for the user. Here's what it looks like:Trading method: The customer decides the trading strategy, which includes rules for entry and exit and position sizing as well as risk management and risk management.

Integration: The trading robot is integrated with a cryptocurrency platform through APIs. This allows it access real-time market information and execute trades.

Algorithm : This bot utilizes algorithms for market analysis and makes trading decisions based upon a defined strategy.

Execution. The bot makes trades in accordance with the trading strategy. It does not require manual intervention.

Monitoring: The bot continuously monitors the market's activity and makes necessary adjustments to trading strategies.

The cryptocurrency trading bots can be used to execute routine or complex trading strategies. This allows for less intervention from a manual standpoint and allows users to profit from market opportunities 24/7. Automated trading has its risks. There is the possibility of security flaws as well as software mistakes. You also have the chance of losing control of your trading decisions. Before you can begin trading live, make sure you thoroughly test and analyze the trading bot.